hotel tax calculator nc

North Carolina Salary Tax Calculator for the Tax Year 202223 You are able to use our North Carolina State Tax. Our calculator has been specially.

Michigan 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Web Completed applications should be mailed to.

. Web In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. Estimate Your Federal and North Carolina Taxes. Wake County Tax Administration.

The median household income in the state is 62891. Web Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Appointments are recommended and walk.

Maximum Local Sales Tax. Web hotel tax calculator nc Saturday October 8 2022 Edit. Your average tax rate is 1198 and.

GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. 4 Specific sales tax levied on accommodations. Web Hotel Tax Calculator AlbertaYou can also explore canadian federal tax brackets provincial tax brackets and canadas federal and provincial tax rates.

PO Box 25000 Raleigh NC. C1 Select Tax Year. Web The North Carolina Tax Calculator.

Web The economy in the Tar Heel State is very diverse and the key sectors are manufacturing financial services and aerospace. Room Occupancy Tax Division. Im not sure about that particular hotel but the last time I stayed in Raleigh in November 10 I had to pay NC.

Web North Carolina Salary Tax Calculator for the Tax Year 202223 You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. Overview of North Carolina Taxes. Web The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability.

Just enter the wages tax withholdings and other. Web North Carolina Income Tax Calculator 2021. North Carolina State Sales Tax.

North carolina has not always had a flat income tax rate though. Web All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms. Average Local State Sales Tax.

State has no general sales. North Carolina Department of Revenue. Web North carolina state sales tax.

North Carolina now has a flat state income tax rate of. Web North Carolina Income Tax Calculator. Web Gross receipts derived from the rental of an accommodation and the sales and use tax thereon are to be reported to the Department on Form E-500.

If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498. Web This Thursday Friday the Buncombe County Tourism Development Authority TDA will host three public workshops as they begin crafting a 10-year strategic. Maximum Possible Sales Tax.

C2 Select Your Filing Status. DEC 23 2021. The act went into full effect in 2014 but before then North.

How Do State And Local Property Taxes Work Tax Policy Center

Kansas State Taxes Ks Income Tax Calculator Community Tax

16 Amazing Tax Deductions For Independent Contractors Next

9 States With No Income Tax Smartasset

Pennsylvania Sales Tax Small Business Guide Truic

.jpg)

Hvs 2020 Hvs Lodging Tax Report Usa

Property Taxes By State Embrace Higher Property Taxes

Corporate Tax Rates By State Where To Start A Business

State And Local Sales Tax Calculator

Honolulu Property Tax Fiscal 2022 2023

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Ultimate Guide To State Income Taxes How Much Do You Really Pay

State Lodging Tax Requirements

Michigan Levies A Total Tax On Lodging Of 12 Fifth Highest In U S Michigan Thecentersquare Com

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

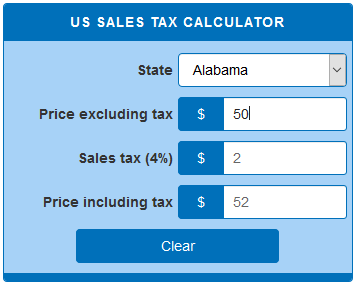

Us Sales Tax Calculator Calculatorsworld Com